business inventories commerce department sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When it comes to understanding the pulse of the economy, few indicators are as crucial as the business inventories tracked and reported by the commerce department. These inventories, which include raw materials, work-in-progress, and finished goods across multiple sectors, serve as a barometer for economic health, growth trajectories, and market stability. The commerce department’s meticulous data collection, validation, and reporting processes enable businesses, analysts, and policymakers to assess trends, make informed decisions, and shape economic strategy. From the role of accurate reporting to the far-reaching impact on GDP calculations and supply chain management, the business inventories commerce department is central to painting a comprehensive picture of the nation’s economic landscape.

Overview of Business Inventories

Business inventories represent a critical component of economic reporting, offering insight into the stock of goods that businesses hold at any given time. These inventories serve as a barometer of supply chain efficiency, demand forecasting, and overall economic health. The way inventories are monitored and evaluated can significantly impact policy decisions and business strategies across various industries.

Significance of Business Inventories in Economic Reporting

The movement of business inventories is closely watched by economists and policymakers because it reflects both consumer demand and business expectations. Rising inventories may signal slowing demand or overproduction, while falling inventories can indicate strong sales or potential supply shortages. This data helps analysts understand how ready businesses are to meet market demand and how production might shift in the near future.

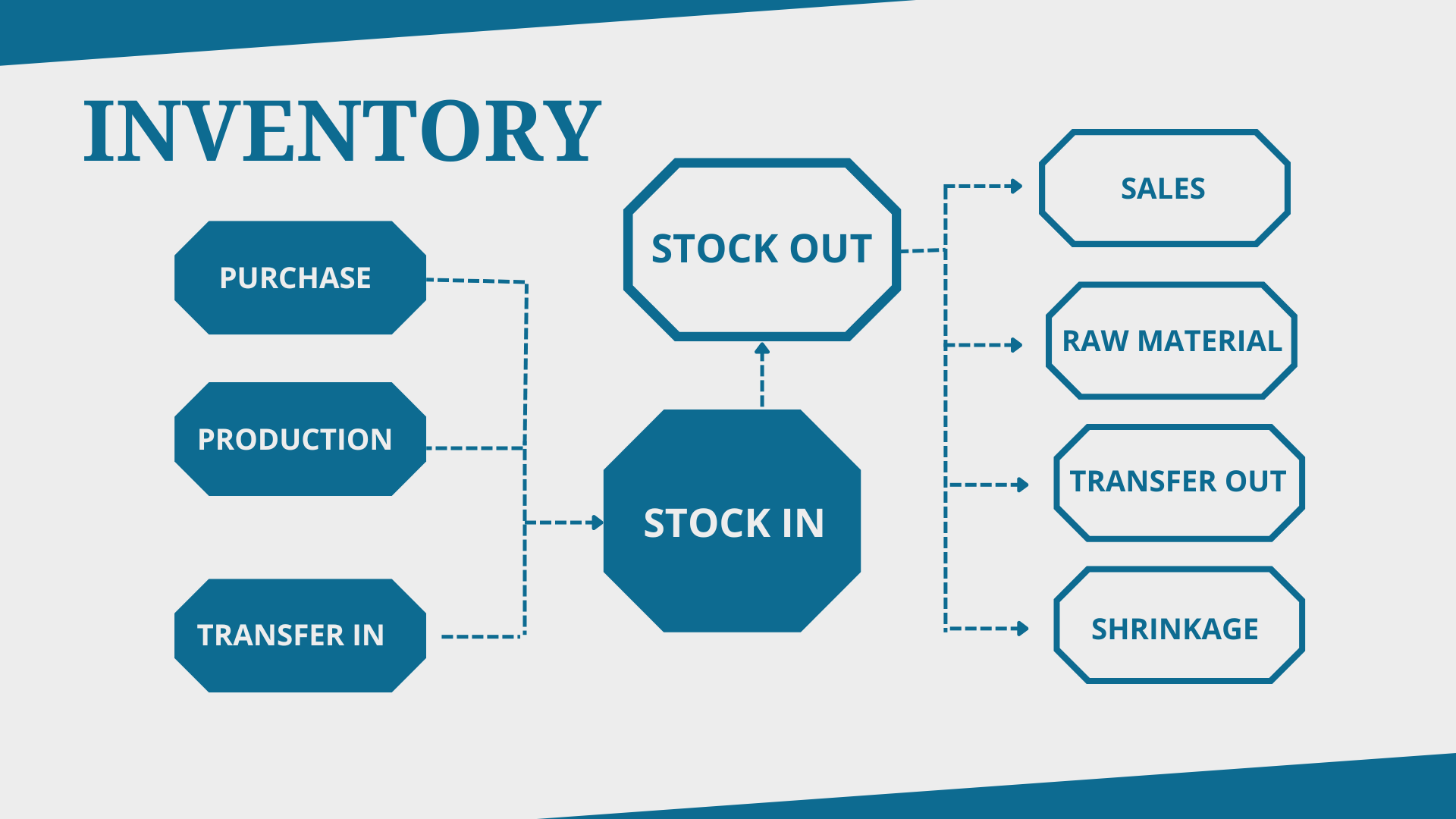

Types of Inventories Included in Commerce Department Reports

Commerce department reports typically categorize business inventories into several types, each capturing a unique segment of the supply chain. Understanding these categories is essential for interpreting the nuances of inventory data.

- Raw materials: Basic inputs awaiting production or manufacturing.

- Work-in-progress (WIP): Items currently undergoing transformation within production facilities.

- Finished goods: Completed products ready for sale to customers or wholesalers.

- Merchandise inventories: Goods purchased for resale by retailers, wholesalers, or distributors.

Main Factors Influencing Inventory Levels Across Industries

Inventory levels fluctuate based on several internal and external factors that affect all sectors differently. Recognizing these drivers helps in analyzing inventory reports more effectively.

- Seasonal demand shifts (e.g., holidays, back-to-school periods)

- Supply chain disruptions or delays

- Technological advancements in inventory management

- Changes in consumer preferences or market trends

- Macroeconomic conditions such as inflation or recession

Primary Sectors Tracked for Business Inventory Data

The commerce department tracks inventory data across a range of sectors to provide a comprehensive outlook on the economy. Below is a list of the main sectors most frequently monitored:

- Manufacturing

- Retail trade

- Wholesale trade

- Automotive industry

- Food and beverage

- Pharmaceuticals

Role of the Commerce Department in Inventory Data Collection

The commerce department plays a pivotal role in gathering and disseminating business inventory statistics, ensuring that economic stakeholders have access to reliable, timely, and comprehensive data. These efforts enable informed decision-making at both public and private levels.

Responsibilities of the Commerce Department

Among its core responsibilities, the commerce department is tasked with designing surveys, collecting raw data, validating responses, and publishing summary reports. This workflow ensures that inventory statistics are accurate and reflective of real market conditions.

Methods for Collecting and Validating Inventory Statistics

To maintain data quality and relevance, the department employs a variety of data collection and validation methods. These range from standardized surveys sent to businesses to audits and cross-verification checks.

- Monthly and quarterly surveys distributed to a representative sample of businesses

- Electronic reporting systems for efficient data submission

- On-site audits and random checks for large enterprises

- Statistical modeling to estimate missing or inconsistent data

Summary of Survey Frequency, Types, and Reporting Formats

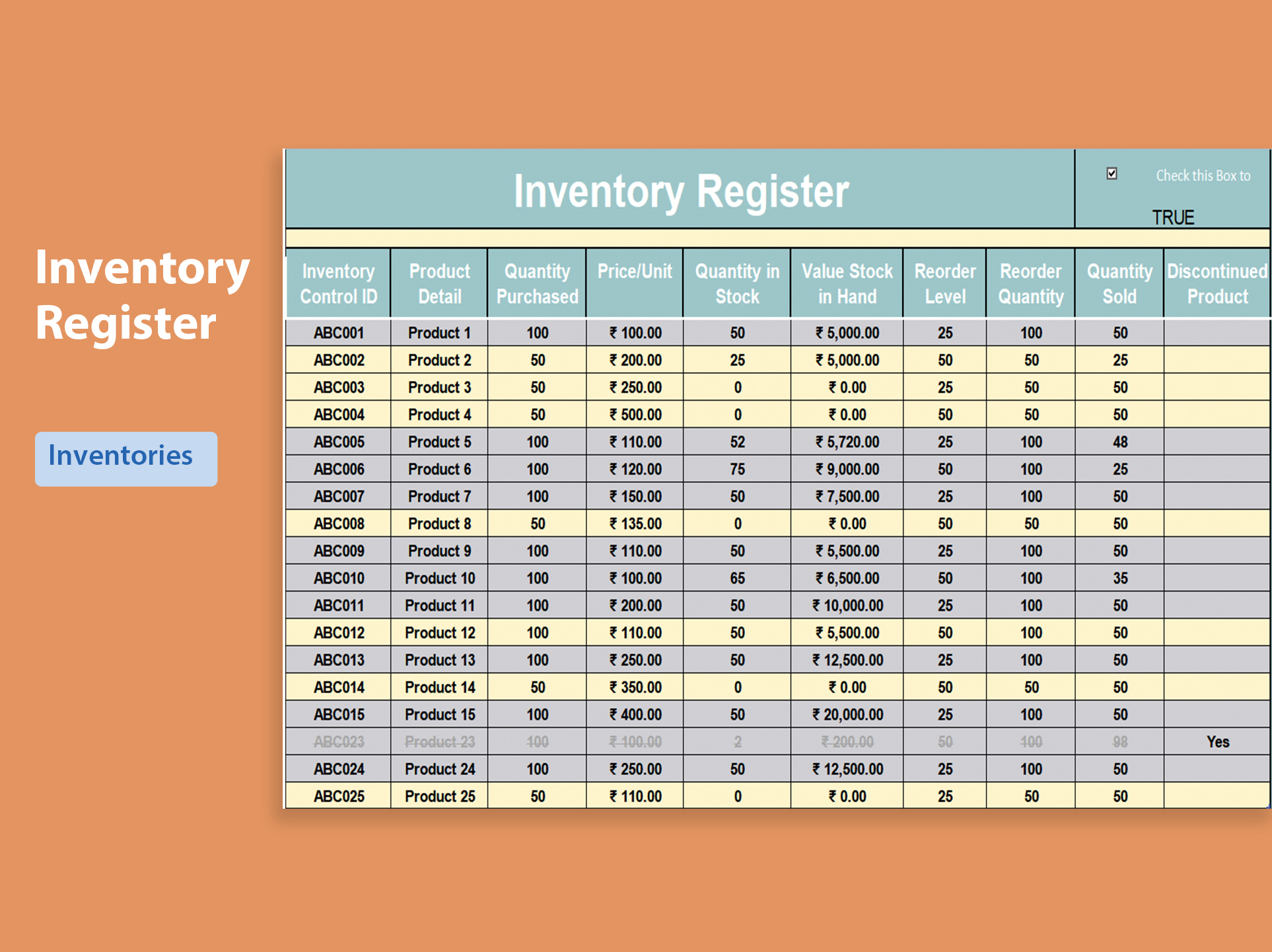

The table below summarizes the key aspects of inventory data collection as implemented by the commerce department:

| Frequency | Survey Type | Reporting Format |

|---|---|---|

| Monthly | Manufacturers’ Shipments, Inventories, and Orders Survey | Online forms, downloadable CSV |

| Quarterly | Wholesale and Retail Trade Inventories Survey | Email submissions, secure web portals |

| Annual | Comprehensive Business Census | Printed forms, electronic uploads |

Collaboration Between Federal, State, and Private Entities

Data collection efforts rely on strong collaboration between government agencies, state departments, and private enterprises. The commerce department works closely with state statistical offices, industry associations, and even large businesses to ensure widespread participation and data reliability. Private sector feedback often helps refine survey design and minimize respondent burden, leading to more robust inventories datasets.

Economic Importance of Business Inventory Reports

Business inventory reports are foundational for economic analysis, revealing not just the volume of goods in the pipeline, but also broader trends that influence growth and policy. Their role extends beyond simple stocktaking, impacting everything from GDP assessments to supply planning.

Impact of Inventory Trends on Economic Growth Assessments

Changes in business inventories can have a direct effect on estimates of economic strength. Rising inventories may build up GDP in the short term if they result from increased production, but they can also signal consumer pullback if sales slow, requiring careful interpretation.

Interrelationship Between Inventory Changes and GDP Calculations

Inventory fluctuations are a key element of the GDP calculation, specifically within the “change in private inventories” component. This means that unexpected buildups or drawdowns in inventories can lead to GDP revisions.

“Change in private inventories is a volatile but significant contributor to quarterly GDP growth, requiring frequent updates as new business inventory data become available.”

Correlation Between Inventory Shifts and Other Economic Indicators

To understand the broader implications of inventory movement, see the table below outlining the typical correlations observed:

| Inventory Change | Sales Trend | Manufacturing Output | Employment Rate |

|---|---|---|---|

| Rising | Stable or Falling | Increasing | Potentially Stable |

| Falling | Rising | Decreasing or Stable | Possible Increase |

Examples of Business and Policymaker Use of Inventory Reports

Inventory data is used both for short-term decisions and long-term planning. Here are some prominent applications:

- Manufacturers adjust production schedules based on shifts in inventory levels.

- Retailers plan stock replenishments and promotional campaigns with inventory trends in mind.

- Policymakers monitor inventory buildups as early warning signs of economic slowdowns.

- Investors analyze inventory data to forecast company performance and industry outlooks.

- Logistics firms optimize warehousing and transportation plans according to inventory flows.

Interpretation of Recent Business Inventory Data

The most recent business inventory releases from the U.S. Commerce Department provide a snapshot of ongoing economic activity, reflecting how supply chains and consumer demand continue to evolve in a post-pandemic environment. These datasets reveal key sectoral variations and help contextualize broader macroeconomic patterns.

Summary of Recent Inventory Data Releases

Recent monthly reports indicate moderate growth in overall inventory levels, especially in the manufacturing and retail sectors. Wholesale inventories, meanwhile, have shown slight volatility due to ongoing global supply chain adjustments.

Inventory Trends Over the Last Five Years, Business inventories commerce department

The table below compares inventory trends from the past five years, highlighting sector-specific changes and broader economic influences:

| Year | Manufacturing | Retail Trade | Wholesale Trade |

|---|---|---|---|

| 2019 | Steady | Rising | Moderate |

| 2020 | Decreased (COVID-19 disruption) | Fell sharply | Fluctuated |

| 2021 | Rebuilding | Recovering | Growing |

| 2022 | Rising | Stable | Rising |

| 2023 | Plateauing | Moderate Growth | Volatile |

Key Patterns and Anomalies in Inventory Figures

In recent data, manufacturing inventories have plateaued as supply constraints eased, while retail inventories saw moderate growth due to restocking and evolving consumer preferences. Wholesale inventories, in contrast, displayed higher volatility, often linked to international supply chain issues and port delays.

Official Commerce Department Statements on Inventory Data

To provide context on the data, here is a notable excerpt from a recent summary statement:

“While inventory levels remain above pre-pandemic norms, the rate of growth has stabilized in most sectors, indicating a gradual adjustment to shifting market conditions and improved supply chain resilience.”

Procedures for Businesses in Reporting Inventories

Accurate and timely inventory reporting is essential for businesses of all sizes, as this data feeds into national economic statistics and influences policy. The commerce department Artikels standard procedures to streamline and standardize the reporting process across industries.

Standard Inventory Reporting Procedures

Most businesses follow structured procedures to ensure their inventory data is correctly submitted. This involves collecting internal inventory records, reviewing for accuracy, and submitting information using designated government portals.

- Compile inventory balances from accounting and warehouse systems.

- Validate totals against physical stock counts and reconcile discrepancies.

- Complete government-provided survey forms or access designated online tools.

- Submit reports within the required timeline, along with supporting documentation.

- Maintain records for potential audit or review by the commerce department.

Required Documentation and Reporting Timelines

Documentation requirements and reporting deadlines vary depending on business size and industry. Large manufacturers and retailers typically face more detailed data requirements and more frequent reporting schedules than smaller firms.

- Monthly reports: Large businesses (e.g., >$100 million annual sales)

- Quarterly or annual reports: Small to midsize businesses

- Supporting documents: Inventory ledgers, stock count sheets, purchase and sales records

Common Challenges During Inventory Data Submission

Several challenges can complicate inventory reporting. Awareness of these hurdles helps businesses better prepare for compliance.

- Inventory miscounts or data entry errors

- Integrating multiple inventory management systems

- Short submission windows and tight deadlines

- Lack of standardized processes across departments

- Limited resources for small businesses

Inventory Reporting Process and Responsible Parties

The table below Artikels the typical steps involved in the inventory reporting process and identifies who is responsible at each stage:

| Step | Description | Responsible Party |

|---|---|---|

| Data Compilation | Collect inventory figures from all relevant business units | Inventory Manager |

| Data Validation | Verify and reconcile physical counts with records | Accounting Department |

| Form Submission | Enter data into commerce department systems | Compliance Officer / Administrator |

| Audit Preparation | Organize supporting documentation for review | Senior Management |

Applications of Business Inventory Statistics in Forecasting

Business inventory figures are indispensable in forecasting models, shaping how companies and policymakers anticipate market developments and plan for the future. Integrating inventory data into forecasting enables more accurate predictions and responsive strategies across many industries.

Use of Inventory Data in Market Trend and Supply Chain Forecasting

By tracking inventory levels, businesses can anticipate shifts in market demand and adjust their production or procurement accordingly. Persistent increases or decreases in inventories signal the need for changes in supply chain operations.

Integration of Inventory Statistics into Forecasting Models

Businesses leverage inventory statistics as part of a broader set of indicators in predictive analytics and demand planning. These models rely on historical trends and real-time adjustments to project future sales and orders more accurately.

- Time series analysis for trend detection

- Regression models relating inventory to sales

- Machine learning algorithms for complex pattern recognition

- Scenario-based simulations for supply chain stress testing

Forecasting Techniques and Their Dependence on Inventory Data

The table below lists common forecasting techniques and the extent to which they depend on business inventory statistics:

| Forecasting Technique | Use of Inventory Data | Industry Examples |

|---|---|---|

| Sales Forecasting | High | Retail, Automotive |

| Demand Planning | Moderate to High | Manufacturing, Electronics |

| Supply Chain Optimization | High | Consumer Goods, Logistics |

| Production Scheduling | Moderate | Chemicals, Food & Beverage |

Industries Benefiting Most from Inventory-Driven Forecasting

Industries with complex supply chains, rapid demand fluctuations, or perishable goods realize the greatest benefit from robust inventory forecasting.

- Retail: Fast response to seasonal and promotional demand spikes

- Automotive: Adjusting production runs in response to dealer inventories

- Pharmaceuticals: Managing expiration risks and regulatory compliance

- Consumer Electronics: Balancing innovation cycles and unsold stock

- Food and Beverage: Reducing spoilage and optimizing replenishment

Visualizing Inventory Data: Business Inventories Commerce Department

The ability to clearly visualize inventory trends is key for communicating complex economic information to both technical and non-technical audiences. Effective visualizations distill large data sets into actionable insights for businesses and policymakers.

Structuring Inventory Trends with HTML Tables for Responsive Display

HTML tables can organize inventory data in a way that is both accessible and flexible for web display. By grouping data by year, sector, or region, users can quickly scan for patterns and anomalies without parsing lengthy text.

Techniques for Presenting Inventory Data Visually

A variety of visualization methods can make inventory data more digestible. Interactive dashboards, bar charts, and line graphs are common formats for summarizing trends. For non-technical audiences, infographics that combine numbers with icons or illustrations provide a clearer, at-a-glance understanding.

- Bar and line charts for tracking inventory changes over time

- Pie charts for showing inventory composition by category

- Stacked area charts to display sector-level comparisons

- Heat maps for geographic breakdowns of inventory levels

- Dashboards with interactive filtering for deeper analysis

Creating Illustrative Charts and Infographics for Inventory Changes

To design effective visual representations, it is important to select chart types that best match the data relationships. For example, time series charts highlight trends, while pie charts are ideal for category shares. Adding labels, color coding, and concise annotations enhances clarity and insight for viewers.

Best Practices in Visualizing Economic Data Sets

Adhering to best practices ensures that key points stand out and that visualizations remain accessible to a wide audience.

- Keep layouts simple and uncluttered to avoid overwhelming viewers.

- Use consistent color schemes to support comparison across datasets.

- Label axes, categories, and units clearly on all charts and tables.

- Highlight key data points or changes with callouts or annotations.

- Ensure visualizations are responsive for viewing on multiple devices.

- Include brief narratives to contextualize complex data graphics.

Last Point

In wrapping up, it’s clear that the business inventories commerce department is not just compiling numbers—it’s translating real-world activity into actionable insights. Through tracking, analysis, and effective communication, this data empowers everyone from small business owners to national policymakers to navigate economic challenges and opportunities. As inventory trends continue to shape forecasts and planning, staying attuned to these reports ensures that businesses and governments alike are better equipped for the future.

FAQs

What types of businesses are required to report inventories to the commerce department?

Most manufacturers, wholesalers, and retailers with significant inventory holdings are required to report, though requirements may vary based on size and sector.

How often does the commerce department release inventory data?

Inventory data is typically released monthly, with some specialized reports published quarterly or annually.

Can small businesses access inventory reporting assistance?

Yes, the commerce department often provides resources, guidelines, and support to help small businesses comply with reporting requirements.

How are inventory figures adjusted for seasonal variations?

The commerce department uses statistical models to seasonally adjust inventory data, ensuring more accurate year-over-year comparisons.

What should I do if I notice an error in my submitted inventory report?

If you spot an error, contact the commerce department as soon as possible to provide corrections or updated information.